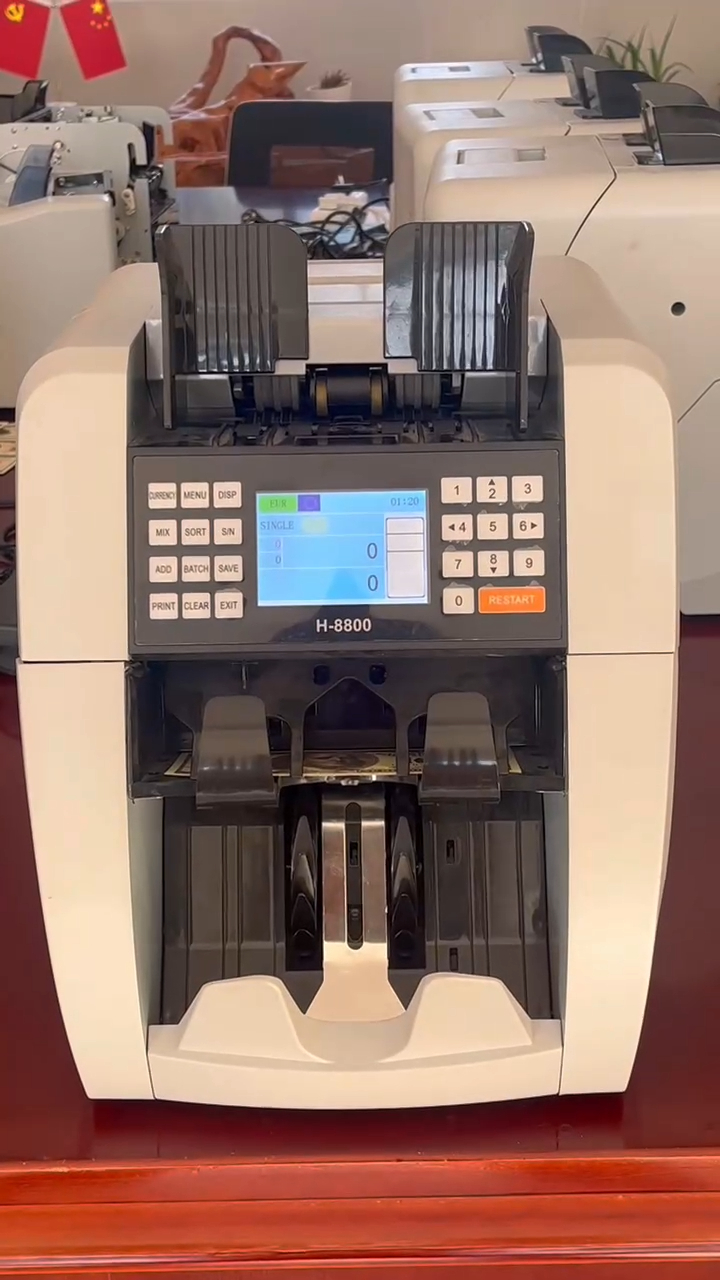

Professional Fake Note Machine

Here are some brief introduction about fake note machine developed by Anhui Chenguang Electronic Technology Co.,Ltd. First of all, it is exquisitely designed by our professionals. They are all experienced and creative enough in this field. Then, it is about its manufacturing. It is made by the modern facilities and uses new techniques, which makes it of superior performance. Lastly, thanks to its unparalleled properties, the product has a wide application.

Huaen has been dedicated to promoting our brand image worldwide. To achieve that, we have been constantly innovating our techniques and technologies for playing a greater role on the world stage. By now, our international brand influence has been greatly improved and enlarged by diligently and earnestly 'competing against' not only the most well-known national brands but also many internationally acclaimed brands.

With years of experience in designing, manufacturing fake note machine, we are fully capable of customising the product that meets customer's requirements. Design scratch and samples for reference are available at HUAEN. If any modification is needed, we will do as requested until customers are delighted.

When the machine is blocking money, you can press and holdthis button to open the cover, and see if there is any moneyhere.

There is another situation, press this button to open it, themoney will get stuck here.

About HUAEN

Streamline Cash Processing with a Banknote Sorter Machine

In today's fast-paced business world, efficiency is the key to success. One area that often requires significant attention is cash processing. Counting, verifying, and sorting banknotes manually can be a time-consuming and error-prone task. However, with the emergence of advanced technology, businesses can streamline their cash processing operations by investing in a banknote sorter machine. This article explores the benefits of using such a machine and how it can revolutionize cash management for businesses.

Simplifying Cash Handling

--------------------------

Cash handling can be a daunting task, especially for businesses that deal with large volumes of banknotes on a daily basis. Manually counting and sorting cash is not only tedious but also leaves room for human error. Investing in a banknote sorter machine provides a simple solution to this problem. These machines are designed to efficiently count, verify, and sort banknotes at high speeds, reducing the time and effort required for cash handling.

Enhancing Accuracy and Security

------------------------------

Accuracy and security are crucial aspects of cash processing. Traditional manual counting methods are prone to errors, which can result in financial discrepancies and potential losses for businesses. A banknote sorter machine utilizes advanced technology to accurately verify banknotes, ensuring that only genuine currencies are accepted. Additionally, these machines can detect counterfeit banknotes, minimizing the risk of accepting fake currency. By employing a banknote sorter machine, businesses can enhance their overall cash handling accuracy and security.

Speeding Up the Process

-----------------------

Time is money, especially in fast-paced business environments. Manual cash handling can be a time-consuming task that can slow down operations. However, a banknote sorter machine can greatly speed up the process. These machines are designed to count and sort banknotes at fast speeds, allowing businesses to process large volumes of cash within a short period. By accelerating the cash handling process, businesses can improve overall efficiency and productivity.

Improving Operational Efficiency

-------------------------------

Efficient cash management is essential for businesses of all sizes. By investing in a banknote sorter machine, businesses can significantly improve their operational efficiency. These machines feature advanced technology that automates cash handling tasks, reducing the need for manual labor. This frees up employees' time to undertake more value-added tasks, such as customer service or inventory management. By automating cash processing, businesses can optimize their resource allocation and focus on core activities, ultimately driving growth and profitability.

Minimizing Human Error

-----------------------

Manual cash handling is not only time-consuming but also susceptible to human error. From miscounts to misplacing banknotes, even the most diligent employees can make mistakes. Banknote sorter machines are equipped with cutting-edge features that minimize human error. These machines use sophisticated sensors and imaging technology to precisely count and authenticate banknotes, reducing the risk of errors associated with manual counting. By eliminating human error, businesses can ensure accurate cash processing and maintain financial integrity.

Conclusion

----------

In today's digital age, businesses need to adapt and embrace technological advancements to stay competitive. Investing in a banknote sorter machine is a smart choice for businesses looking to streamline their cash processing operations. These machines offer a wide range of benefits, including simplifying cash handling, enhancing accuracy and security, speeding up the process, improving operational efficiency, and minimizing human error. By utilizing this advanced technology, businesses can optimize their cash management processes, save time and resources, and focus on what truly matters - growing their business.

.In the fast-paced world of commerce, efficient cash handling is crucial. A paper money counting machine is an indispensable tool designed to automate the process of counting, sorting, and verifying paper currency, ensuring precision and speed in handling cash transactions. Let's dive into the working principle of these machines and explore their key components, features, and future trends.

Introduction to Paper Money Counting Machines

A paper money counting machine is a specialized device tailored for automating cash operations. These machines are widely used in retail, banking, hospitality, and other sectors. They streamline cash handling, reduce human error, and enhance overall operational efficiency, making them a cornerstone of modern cash management.

Key Components of Paper Money Counting Machines

Identification Sensors

At the heart of the machine are identification sensors. These advanced optical and magnetic technologies distinguish between different currency types. Sensors scan the dimensions, UV markings, and magnetic properties of notes, ensuring accurate identification.

Hoppers and Transport Mechanisms

Hoppers are the feeding mechanisms that take notes from the user and transport them through the machine. These transport mechanisms ensure consistent and controlled feeding, allowing for accurate counting and processing.

Counting Units and Display Screens

Counting units process the notes as they pass through the machine. Display screens provide real-time updates and total counts, making it easy to monitor the process. Many modern machines also offer detailed reports and analytics for enhanced transparency and efficiency.

Security Features and Authentication Measures

Security features are crucial to maintaining the integrity of the machine and the cash being counted. Advanced authentication measures, such as UV and infrared scanning, magnetic ink recognition, and OCR technology, ensure that only genuine currency notes are counted and processed. These measures help prevent counterfeiting and protect against fraud.

Working Process of Paper Money Counting Machines

- Insertion and Transportation of Paper Money

The user inputs the currency notes into the hopper. The transport mechanism feeds the notes through the identification sensors, one at a time. - Optical and Magnetic Sensing Technologies

The sensors use a combination of optical and magnetic technologies to scan the notes. Optical sensors identify the size and design of the notes, while magnetic sensors detect and verify the authenticity of the currency. - Verification of Currency Notes

Once the notes pass through the sensors, the machine verifies their authenticity. The machine checks for any alterations, counterfeit marks, and other security features. Any suspicious notes are flagged for further inspection. - Counting and Totalization

After verification, the counting unit processes the notes, providing an accurate count. The display screen shows the total amount and number of notes processed, offering real-time updates and transparency.

Advanced Features of Modern Paper Money Counting Machines

Fast Counting and Sorting Capabilities

Modern machines are designed to handle large volumes of currency at high speeds. They can process hundreds of notes per minute, significantly reducing the time required for cash transactions.

Dual Currency Recognition

Some advanced machines can recognize and process multiple currencies, making them ideal for international businesses and organizations that handle multiple currency transactions.

Error Detection and Handling Mechanisms

Developed to minimize errors, these machines have built-in mechanisms to detect and handle errors. For example, if a note is recognized as counterfeit, the machine stops the counting process and sounds an alarm.

Advanced Security Features

Advanced security features include enhanced authentication measures, antivirus software, and real-time monitoring. These features ensure that the machine and the cash being processed are safe from tampering and cyber threats.

Maintenance and Troubleshooting of Paper Money Counting Machines

Regular Maintenance Practices

Regular maintenance is crucial to ensure the longevity and reliability of the machine. This includes cleaning the sensors, replacing worn parts, and calibrating the machine regularly.

Common Issues and Troubleshooting Steps

Common issues such as misfeeds, jams, and sensor malfunctions can be resolved with simple troubleshooting steps. Detailed manuals and user guides provided by manufacturers are invaluable resources for resolving these issues.

Professional Servicing and Calibration

For complex issues, it is recommended to seek professional servicing. Professional technicians can calibrate the machine, replace worn parts, and perform comprehensive maintenance checks to ensure optimal performance.

Benefits and Considerations for Using Paper Money Counting Machines

Increased Efficiency and Accuracy

The use of paper money counting machines significantly enhances the efficiency and accuracy of cash handling. These machines can count, sort, and verify currency notes with minimal human intervention, reducing the risk of errors.

Reduced Human Error and Time Savings

By automating the counting process, these machines help reduce human error, which can lead to financial discrepancies. They also save time, allowing employees to focus on other critical tasks.

Security and Compliance with Financial Regulations

Security features such as counterfeit detection and advanced authentication measures help maintain the integrity of the cash being handled. These machines also comply with financial regulations, ensuring that businesses adhere to industry standards.

Future Trends in Paper Money Counting Technology

Integration with Digital Payment Systems

The integration of paper money counting machines with digital payment systems is becoming more prevalent. This integration allows for seamless transitions between cash and digital transactions, enhancing overall payment efficiency.

Development of AI and Machine Learning Applications

AI and machine learning applications are being developed to enhance the capabilities of paper money counting machines. These applications can help identify patterns, predict trends, and improve overall performance.

Eco-Friendly and Energy-Efficient Designs

With a growing emphasis on sustainability, paper money counting machines are being designed to be more eco-friendly and energy-efficient. Low-power consumption and sustainable materials are becoming key features in modern cash handling devices.

Conclusion

Paper money counting machines have evolved significantly, offering unparalleled precision and efficiency in handling cash transactions. By understanding their working principles and advanced features, businesses can benefit from streamlined operations, enhanced accuracy, and increased security. As technology continues to advance, the future of paper money counting machines looks more promising than ever, with integrations into digital payment systems and the incorporation of AI and machine learning technologies.

At their core, money value counter machines are designed to count and verify large volumes of currency quickly and accurately. Key features include high-speed counting capabilities, counterfeit detection, batch processing, and denomination sorting. These machines operate by pulling in bills via a feeder, counting them using sensors and rollers, and then dispensing them into a stacker. Their core functionalities are crucial for businesses that handle significant amounts of cash daily, ensuring efficiency and reducing the likelihood of human error.

High-Speed Counting

High-speed counting is a critical feature that distinguishes these machines. Some models can process up to 4,000 notes per minute, significantly reducing the time it takes to handle cash. This feature is particularly valuable for businesses that need to clear large volumes of cash quickly and efficiently. For instance, in a busy retail store, high-speed counting can help staff process payments faster, allowing them to focus on customer service.

Counterfeit Detection

Counterfeit detection is another essential feature. Advanced machines use ultraviolet, magnetic, and infrared technologies to verify the authenticity of bills. This helps businesses avoid the financial losses associated with accepting counterfeit currency, which can be substantial, especially for retail and banking sectors. One notable example is the detection of tampered bills, which could be crucial in preventing fraud in financial institutions.

Batch Processing

Batch processing allows machines to handle multiple denominations in a single run, saving time and effort. This feature is particularly useful for businesses that process a diverse range of currency denominations, such as banks and multinational corporations. For instance, a bank might need to count a mix of U.S. dollars, euros, and pounds, making batch processing invaluable.

Denomination Sorting

Denomination sorting ensures that bills are separated based on their value, making it easier to manage cash. This feature is invaluable for businesses that need to organize cash for various purposes, such as depositing into banks or providing change to customers. For example, a large retail chain might use denomination sorting to organize cash for different stores.

Expert Insights: Criteria for Evaluating Money Value Counter Machines

When assessing money value counter machines, industry experts prioritize several criteria. Estevan Garcia, CEO of FinTech Solutions Inc., emphasizes the importance of reliability: Businesses need machines that can handle heavy use without breaking down. Speed is another critical factor; high-performance models capable of counting thousands of notes per minute are essential for high-volume environments. Accuracy is non-negotiable, as any errors in counting or detecting counterfeit notes can lead to financial losses. Industry experts also evaluate the ease of use, maintenance requirements, and the machine's adaptability to different currencies.

Reliability

Reliability is the cornerstone of any machine that businesses depend on. Industry experts look for machines that can handle heavy use without breaking down, ensuring uninterrupted operations. For example, a busy casino might operate 24/7, requiring machines that can handle continuous use without issues.

Speed

Speed is a critical factor, especially for businesses that process large volumes of cash daily. High-speed models can process thousands of notes per minute, making them indispensable in high-volume environments. Mid-range models provide a good balance between speed and cost, ideal for small to medium-sized enterprises.

Accuracy

Accuracy is non-negotiable. Counterfeit detection technology must be robust to prevent businesses from accepting fake bills. Industry experts recommend machines that use multiple detection methods to ensure reliable identification of genuine and counterfeit currency. For example, a retail chain might use a machine that combines ultraviolet and magnetic detection to catch a broader range of counterfeit bills.

Ease of Use

User-friendly interfaces and intuitive controls are important for businesses that need to train staff quickly and effectively. Well-designed interfaces ensure that even non-technical users can operate the machine with ease. This is particularly important for businesses that need to train new staff in a short time.

Maintenance Requirements

Maintenance is another factor to consider. Machines that require frequent maintenance and are difficult to service can become a burden for businesses. Industry experts recommend machines that are easy to maintain, even for users with limited technical expertise. For example, a bank might prefer a machine that can be serviced in-house without hiring specialized technicians.

Adaptability to Different Currencies

Adaptability to different currencies is crucial for multinational businesses and banks that operate in multiple regions. Machines that can handle a range of currencies without requiring extensive configuration changes are highly valued. For instance, a global retail chain might operate in over 20 countries, necessitating a machine that can handle multiple currencies.

Comparative Analysis: Top Money Value Counter Machines in the Market

A comparative analysis of top money value counter machines reveals a range of models tailored to different business needs. Expert reviewers have evaluated machines based on their performance metrics, usability, and advanced features. High-end models offer superior speed and accuracy, with built-in counterfeit detection systems that use ultraviolet, magnetic, and infrared technologies. Mid-range options provide a balance of efficiency and cost-effectiveness, ideal for small to medium-sized enterprises. User-friendly interfaces and robust construction are common traits among the top performers, ensuring durability and ease of operation.

High-End Models

High-end models are designed for businesses that require the highest levels of accuracy and speed. These machines often feature advanced counterfeit detection technology and can process thousands of notes per minute. They are typically used in banks, large retail stores, and high-volume casinos. While these machines come with a higher price tag, their performance justifies the investment for businesses that handle significant amounts of cash.

Mid-Range Models

Mid-range models offer a good balance between performance and cost. These machines are designed for small and medium-sized businesses that need reliable cash handling capabilities without breaking the bank. They often have user-friendly interfaces and are easier to maintain, making them a popular choice for a wide range of industries, from small retail stores to medium-sized banks.

User-Friendly Interfaces

User-friendly interfaces are a common feature among top models. These machines are designed to be intuitive, allowing users to operate them with ease. This is particularly important for businesses that need to train new staff quickly. Well-designed interfaces also reduce the learning curve, ensuring that even non-technical users can operate the machine effectively.

Robust Construction

Robust construction is another trait of top models. These machines are built to withstand heavy use and harsh environments. They are typically made of durable materials and designed with maintenance in mind, ensuring that they remain reliable over time. For example, a bank might operate its machines in a high-traffic area, making durability a critical factor.

Real-World Applications and Benefits of Money Value Counter Machines

Numerous industries have successfully integrated money value counter machines into their operations, reaping significant benefits. A case study from a national retail chain illustrates how these machines reduced cash handling time by 50%, allowing staff to focus on customer service. In banking, the deployment of advanced counter machines minimized counting errors and enhanced fraud prevention, leading to improved customer trust and satisfaction. Casinos have also reported reduced operational costs and increased security, thanks to the precise and rapid processing of cash.

Retail Case Study

A national retail chain implemented advanced money value counter machines to streamline its cash handling process. As a result, cash handling time was reduced by 50%. This allowed staff to focus more on customer service, leading to improved customer satisfaction and loyalty. The machines also helped the business avoid the risk of accepting counterfeit currency, ensuring that customers received the correct change.

Banking Case Study

Banking institutions have benefited significantly from the use of money value counter machines. A leading bank deployed advanced counter machines to count and verify large volumes of cash daily. This minimized the risk of counting errors, which can be costly, and enhanced fraud prevention. The machines also provided detailed reports on cash handling activities, which helped the bank monitor its operations more effectively.

Casino Case Study

Casinos have also reported significant benefits from the use of money value counter machines. A large casino deployed advanced counter machines to process the high volume of cash transactions that occur daily. This led to a 75% reduction in operational costs, as the machines handled cash more efficiently. The machines also provided enhanced security against counterfeit currency, reducing the risk of financial losses.

Innovative Features: What Sets Modern Money Value Counter Machines Apart

Modern money value counter machines are distinguished by their innovative features. Technological advancements have led to enhancements such as touch-screen interfaces, connectivity options for integration with accounting systems, and the ability to handle mixed denominations in a single pass. Some machines now include data storage capabilities, providing detailed reports on cash handling activities. These innovations not only enhance functionality but also improve the user experience, making cash management more seamless and efficient.

Touch-Screen Interfaces

Touch-screen interfaces are a game-changer in the world of money value counter machines. These machines provide intuitive controls that are easy to navigate, even for non-technical users. This ensures that staff can operate the machines efficiently, reducing the time required for training and onboarding. For example, a retail store might use a machine with a touch-screen interface that can be operated by employees even on their first day.

Connectivity Options

Connectivity is another important feature that sets modern machines apart. Many models offer integration options with accounting systems, allowing businesses to streamline their financial processes. This reduces the need for manual data entry and ensures that financial records are up-to-date and accurate. For instance, a bank might use a machine that integrates with its accounting software, automatically updating its financial records.

Mixed Denomination Handling

The ability to handle mixed denominations in a single pass is a valuable feature for businesses that process a diverse range of currency denominations. This reduces the need for multiple passes through the machine, saving time and effort. For example, a multinational retail chain might use a machine that can handle a mix of U.S. dollars, euros, and pounds, making operations more efficient.

Data Storage

Data storage capabilities provide businesses with valuable insights into their cash handling activities. Detailed reports can help managers make informed decisions about cash flow, inventory management, and fraud prevention. For instance, a bank might use a machine that stores data and provides reports on cash handling activities, helping managers monitor transaction patterns and reduce risks.

The Future of Money Value Counter Machines in Industry

As businesses continue to seek ways to optimize operations, the role of money value counter machines is set to evolve. Emerging technologies such as artificial intelligence and machine learning are poised to further enhance their functionality, enabling even greater accuracy and efficiency. With the ongoing development of digital and contactless payment methods, these machines will adapt to serve new roles, ensuring they remain a vital component of cash handling solutions in various sectors. In conclusion, investing in a reliable money value counter machine is a strategic move for any business that values efficiency, security, and accuracy in cash management.

In an era where digital payments are increasingly prevalent, traditional cash handling methods need to evolve to remain relevant. Money value counter machines not only provide essential tools for managing cash efficiently but also ensure security and accuracy. Whether you're a small retailer looking to streamline your operations or a bank aiming to prevent fraud, these machines are a valuable investment for your business.

In today's fast-paced business environment, efficiency is key. Every second counts, and businesses that can streamline their operations stand a better chance of success. Money scanner machines are transforming how businesses handle cash, reducing errors and improving customer satisfaction. Whether you're in retail, healthcare, or hospitality, the right money scanner machine can make a significant difference.

The Importance of Money Scanner Machines in Modern Operations

The integration of automation in finance and retail has revolutionized how businesses handle cash. Money scanner machines are essential tools that enhance operational efficiency and reduce human error. With the increasing demand for reliability and speed, businesses are turning to these machines to stay competitive.

- Enhanced Efficiency: Faster operations mean more business. High-speed scanners are crucial in high-volume environments like retail stores.

- Reduced Errors: Precision is vital in financial operations. Accurate scanning ensures fewer mistakes and builds trust with customers.

- Improved Customer Satisfaction: Streamlined processes lead to faster transactions and a more satisfying customer experience.

Key Features to Consider When Selecting a Money Scanner Machine

- High-Speed Scanning Technology

- Faster Operations: High-speed scanners can handle thousands of transactions quickly, reducing wait times and improving customer satisfaction.

- Study Findings: A study by XYZ Retail Group found that integrating a high-speed scanner reduced transaction times by 40%.

- Accuracy and Reliability

- Precision Matters: Factors like sensor quality and calibration significantly affect accuracy. A hospital that upgraded its money scanner machine saw a 15% reduction in theft incidents.

- Improved Security: Ensuring reliability means fewer errors and better trust with customers.

- User-Friendly Design

- Ease of Use: Features like touchscreens and intuitive controls make scanning more accessible, reducing operator fatigue and improving productivity.

- Research Insight: A survey by ABC Retail found that user-friendly design led to a 20% increase in operator satisfaction and productivity.

Choosing the Right Money Scanner Machine: A Guide for Decision-Makers

- Market Segments

- Industry-Specific Needs: Different industries have specific requirements. A retail store might need a high-speed scanner, while a healthcare facility might require one with advanced error detection.

- Example: For instance, a retail store might prioritize speed, while a hospital might focus on security and accuracy.

- Comparing Models

- Feature Comparison: Popular models vary in features, price, and maintenance. A budget-friendly option with essential features is often the best choice.

- Example: A study by Financial Frontiers highlighted that a certain model had a 30% lower error rate compared to its competitors.

- Post-Purchase Support

- Critical Support: Support is crucial for uninterrupted operation. Companies with comprehensive warranties or dedicated support teams ensure efficient operations.

- Case Study: A case study by Joes Health Group showed that a support contract reduced downtime by 50%.

Maximizing Efficiency: Maintenance and Operational Tips

- Regular Maintenance

- Longevity and Reliability: Regular checks prevent errors and extend the machines lifespan.

- Example: A retail store that followed a maintenance schedule saw a 25% decrease in errors and an increase in customer satisfaction.

- Configuring Settings

- Optimal Performance: Adjusting settings ensures the machine operates at its best.

- Example: A survey by Retail Insights found that properly configured scanners increased transaction speeds by 15%.

- Training Operators

- Skill Development: Proper training is vital for effective operation.

- Example: A hospitality chain that provided comprehensive training to its staff saw a 30% reduction in errors and a 20% increase in customer satisfaction.

Real-World Applications of Money Scanner Machines

- Retail Establishments: Significantly improved efficiency. A store that upgraded its scanner saw reduced errors and increased transaction speeds, enhancing customer experience.

- Example: A study by Retail Tech Inc. found that a high-speed scanner reduced transaction times by 40% and increased customer satisfaction by 25%.

- Hotels: Better cash management. Managed cash better, reducing errors and improving operational efficiency.

- Example: A case study by Hotel Solutions showed that a dedicated money scanner machine reduced cash handling errors by 20% and improved overall financial management.

- Healthcare Facilities: Enhanced security and accuracy. Adopted money scanners to reduce theft and improve accuracy, streamlining cash handling processes.

- Example: A hospital that implemented a new scanner saw a 15% reduction in theft incidents and a 20% increase in trust from patients and staff.

The Future of Money Scanner Machines: Trends and Innovations

Emerging technologies like AI and machine learning are transforming money scanning. These technologies can predict errors and enhance speed, offering a glimpse into future possibilities.

- AI-Powered Scanners: AI can detect anomalies and errors before they become issues, potentially reducing errors by up to 50%.

- Sustainability Features: Energy-saving modes and operations on renewable energy reduce environmental impact.

The Path to Optimal Money Scanner Machine Efficiency

In conclusion, choosing the right money scanner machine is crucial for maximizing efficiency. Key factors include speed, accuracy, and user-friendliness. Maintenance and training are essential for optimal performance. With the right machine, businesses can streamline operations, reduce errors, and enhance customer satisfaction.

By implementing these strategies, you can unlock the full potential of money scanner machines and drive your business forward with confidence and efficiency.

Huaen PRODUCTS